vermont sales tax food

Taxation and Finance Chapter 233. This page describes the taxability of food and meals in Vermont including catering and grocery food.

Groceries and clothing are exempt from the Dover and Vermont state sales taxes.

. Unless the context in which they occur requires otherwise. File Form SUT-451 Sales and Use Tax Return. 9701 9701.

Vermont Department of Taxes. Use tax has the same rate rules and exemptions as sales tax. What Is It and When Does It Apply.

If you have a single location and cannot file and pay through myVTax you may still use the paper forms. Meaning you should be charging everyone in your state the rate where the item is being delivered. FS-1040 What Caterers Should Know About Vermont Business Taxes.

GENERAL PROVISIONS Cite as. FS-1021 Vermont Rooms Tax for Businesses. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

Application for Refund of VT Sales and Use Tax or Meals and Rooms Tax. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. It does not matter whether you are purchasing canned.

To determine tax due multiply the sale amount by 9 or 10 if the sale is subject to local option tax and round up to the nearest whole cent according to the following rules. The Alcoholic Beverage Tax is 10. The maximum local tax rate allowed by Vermont law is 1.

Are groceries taxed in Vermont. To learn more see a full list of taxable and tax-exempt items in Vermont. Dog grooming boarding ski rentals landscaping.

What is the local sales tax rate in Vermont. What is sales tax on food in Vermont. Prepared Food is subject to special sales tax rates under Vermont law.

The Dover Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Dover local sales taxesThe local sales tax consists of a 100 city sales tax. Remote sellers and marketplace facilitators must collect Vermonts sales tax on retail sales into the state if their gross receipts for the previous. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

9741 13 with the exception of soft drinks. 974113 with the exception of soft. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0156 for a total of 6156 when combined with the state sales tax.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. Sales of food 893m Energy purchases for a residence 397m Clothing and footwear 331m Medical products 548m Agricultural inputs 169m. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

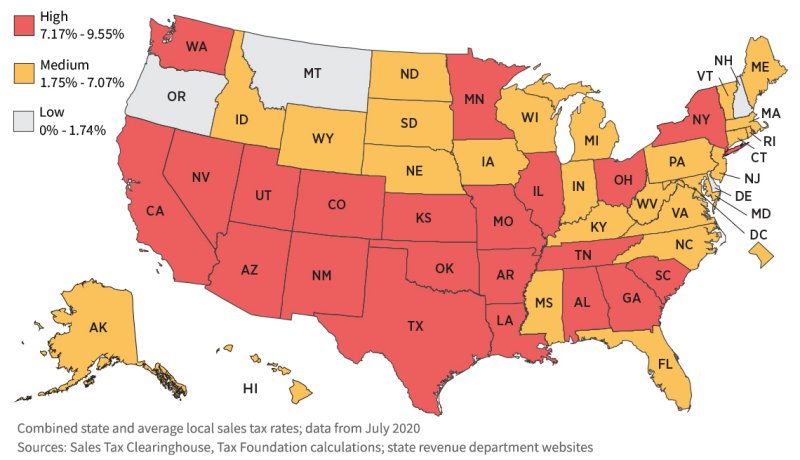

For more information on Vermont Sales and Use Tax and exemptions see Vermont law at 32 VSA Chapter 233 and Vermont regulation at Reg. FS-1012 Local Option Tax. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate. Soft drinks sold in vending machines and as part of a taxable meal such. Soft drinks subject to the Vermont Meals and Rooms Tax.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. Learn more about Vermont Sales and Use Tax. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax.

974113 with the exception of soft drinks. What is food tax in Vermont. Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

Free Unlimited Searches Try Now. FS-1020 Vermont Meals Tax for Businesses. FOOD FOOD PRODUCTS AND BEVERAGES - TAXABLE.

There are 46 exemptions from the Sales and Use Tax including clothing and food. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Another example is food sold by a grocery store or market and which is intended for human consumption later off the premises of the seller.

The Dover Sales Tax is collected by the merchant on all qualifying sales made within Dover. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. If you must pay sales and use tax for multiple locations or if your total sales and use tax remitted for the year will exceed 100000 the Commissioner of Taxes has mandated that you use myVTax.

The Vermont Statutes Online Title 32. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale. Are groceries taxed in Vermont.

The Vermont Sales and Use Tax is imposed on the exempted by law. Sales Tax on Services Study January 2016 Examples of services we tax. This page discusses various sales tax exemptions in Vermont.

9701 31 and 54. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The state sales tax rate in Vermont is 6.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. For further guidance on beverages that. In most states necessities such as groceries clothes and drugs are exempted from the sales tax or charged at a lower sales tax rate.

The Vermont Meals and Rooms Tax is 9. SALES AND USE TAX Subchapter 001. The 10-percent tax also applies to alcohol served for immediate consumption.

If the alcohol is being delivered the delivery fee is part of the meal price and is also taxable. 974113 with the exception. Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates.

Sales tax and use tax work together to create the same tax result whether a seller collects sales tax or not. Soft drinks are subject to Vermont tax under 32 VSA. Vermont is a destination-based sales tax state.

This page describes the taxability of clothing in Vermont. Ad Lookup VT Sales Tax Rates By Zip. You can lookup Vermont city and county sales tax rates here.

970131 and 54. Examples of Sales Subject to the Sales and Use Tax Sales of tangible personal property. Tax computation must be carried to the third decimal place and.

To learn more see a full list of taxable and tax-exempt items in Vermont. FS-1019 Vermont Meals and Rooms Tax for Business. Sales Tax Exemptions in Vermont.

A recent bureaucratic report recommends expanding Vermonts sales tax to include food groceries electricity and clothing to. This means that an individual in the state of Vermont purchases school supplies and books for their children. Effective July 1 2015 soft drinks are subject to Vermont tax under 32 VSA.

Vermont Bun Baker Cookstove Baker S Oven

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Vermont Sales Tax Information Sales Tax Rates And Deadlines

22 States Considered Eliminating The Tampon Tax This Year Here S What Happened The New York Times

Vermont Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

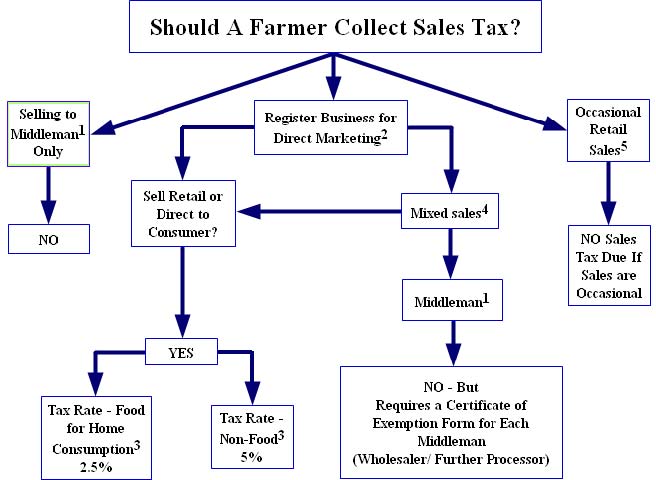

Direct Marketers And The Virginia Sales Tax

Exemptions From The Vermont Sales Tax

Sound Money Index Gold Silver Laws In 2020 Money Index Sound